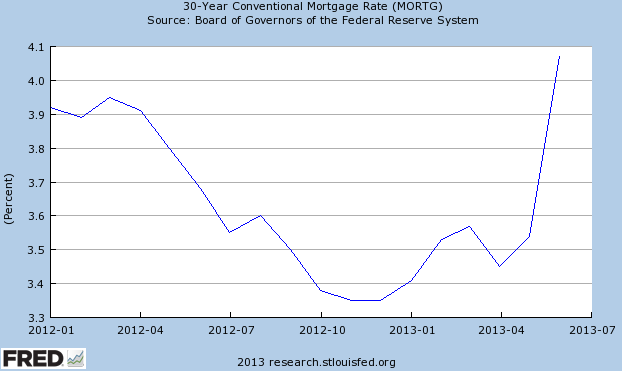

The recent market focus has been centered on Ben Bernanke's comment that the end is near for a very accommodating Federal Reserve, i.e., quantitative easing (QE) tapering is near. The market's reaction was one where the 10-year Treasury rate shot higher (prices declined) as evidenced in the below chart. This rise in rates also influenced mortgage rates as detailed in the second chart below.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Consuelo Mack of WealthTrack noted prior to her interview (link below) with Richard Bernstein and Dan Fuss that investors pulled $60 billion out of bond mutual funds. As a point of reference, in the four years (2009 - 2012) investors poured $1.1 trillion into the fixed income or bond asset class. Trim Tabs reports investors are now putting these funds into stock or equity funds. As an aside Trim Tabs notes historically the individual investor has been extraordinarily bad at market timing.

In Consuelo Mack's recent interview with Richard Bernstein, a top-ranked strategist, turned portfolio manager, and Dan Fuss, a Loomis Sayles’ bond fund manager, both provide their contrarian views as to whether the 30-plus years of falling interest rates may be winding down. Bernstein favors the US domestic equity market and particularly mid-cycle companies. Mid cycle firms tend to be industrials, manufacturing, some technology companies and some financials. They are not commodity and energy related companies.

As it relates to manufacturing in the U.S., WealthTrack has provided a report prepared by Nancy Lazar's new firm, Cornerstone Macro. Lazar was a co-founder of her former firm, the highly rated ISI Group, one of the top economic/strategy firms on Wall Street. This new report notes that Cornerstone's favorite emerging market is Middle America. Cornerstone believes a decoupling is taking place between the US and emerging market economies due to competitive labor cost in the US and favorable energy costs in the US.

No comments :

Post a Comment