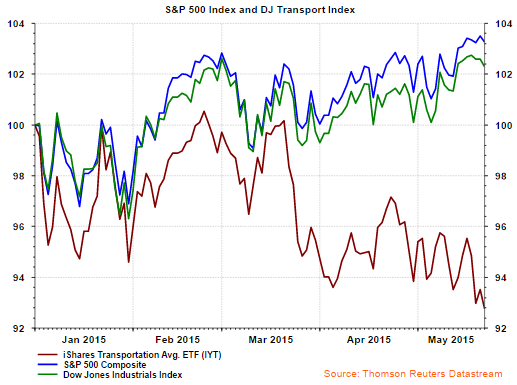

The disconnect between the performance of the Dow Jones Industrial Index and the Dow Jones Transportation Index has some market strategists suggesting the broader equity market is setting the stage for a correction. The correction thinking is based on the theory that weakness in transports is indicative of less goods being moved in the economy and thus a signal of a slowing economic environment. From a more technical perspective, some strategist look at the Dow Theory as being able to signal a market correction.

As the below chart shows the transportation index has underperformed both the Dow Jones Industrial Index and the broader S&P 500 Index. This underperformance began to accelerate in mid-March. For investors though, evaluating the actual causes of weakness in the transports will provide insight into the slowing rail segment of the market and whether these factors are broad based ones or simply industry specific ones.

|

| From Blog of HORAN Capital Advisors 5 2015 |

The largest industry segment in the transportation index is trucking and railroads as noted in the below chart. The railroad segment itself accounts for about 25% of the transportation index. All four rail stocks in the index have generated a negative return this year with Kansas City Southern (KSU) being the worst index performer - down 23% year to date.

|

| From Blog of HORAN Capital Advisors 5 2015 |

So looking at the rails, what are rail company executives saying about their businesses? At the Wolfe Trahan Transport Conference last week, KSU's CFO made the following comments about their business.

- "But when you see natural gas prices drop, magnitude of 50% from a year ago, we've seen some fairly significant impacts in our coal business (emphasis added)."

- "We have a large customer who represents, at least at peak was almost 40% of our coal business...And at one point they were about 6% of our consolidated revenues. In the first quarter, they were 0.5% of our consolidated revenues, huge impact for us. These are current numbers this quarter. They have shipped exactly one unit train. And a year ago at this point in time, they had shipped 80 unit trains."

- "We have a significant maintenance project in Laredo in our subdivision there. The good news is that is now wrapped up. We also have an interchange partner that we operate on some of their track in Southern Texas under The Trackage Rights Agreement, they had a major maintenance program going on at the same time. And the issue is, this is a single line network (emphasis added). So when you shut the network down for 10 or 12 hours a day to do a tire replacement, as an example, you're literally stopping trains from moving, so they go off into sidings until the engineering crew is done, the maintenance crew is done, and then you open back here, your network. So, with that behind us, we should begin seeing improvement in our service levels there."

At Bank of America's Transportation Conference on May 14th, CSX's CFO noted,

- More and more of our business is moving away from coal (emphasis added) towards that more service-sensitive cargo such as merchandise and intermodal..."

- "Are we seeing an economy that is any different than what we've seen before? I don't think so. I think that we are continuing to see an economy that is growing in that 2%, 2.5%, maybe somewhere around three percent."

- "if you go back to 2006 it's over 50% of our utility coal business that has gone away..."

And weakness in the chemical segment of the economy has been a concern for the market as well. Investors should note that frac sand is included in chemicals and the decline in drilling activity has negatively impacted the frac sand market demand.

- "I think from our chemical loadings, when we present our numbers, we have frac sand in there. And clearly frac sand, after having grown 30%, 35% annually for the last three years, we are now seeing a step down probably in that 20%-plus range here this year because of what is going on with the drilling activities."

Andrew Thrasher, CMT, a portfolio manager in Indianapolis, IN, recently noted the divergence in performance of the transports and industrial indices as well. He shows in the below chart that the transportation index has approached oversold levels from a technical perspective. Certainly there are other components of the transport index besides the railroads and weakness has been seen in those industries as well. The second worst performing stock in the transport index is the airline United Continental (UAL), down almost 20% year to date.

|

| From Blog of HORAN Capital Advisors 5 2015 |

Source: Andrew Thrasher, CMT (twitter)

The trucking industry has experienced weakness too. In April the ATA Truck Tonnage Index declined 3% compared to March. On a year over year basis the index was up 1%. Some of the weakness seen in trucking may be a result of the West Coast port shutdown which was resolved in late February. The West Coast ports handle 40% of incoming cargo shipments into the U.S. Clearing the backlog of incoming shipments could take several months, yet lead to better trucking volumes later in the second quarter.

|

| From Blog of HORAN Capital Advisors 5 2015 |

In conclusion, I believe there are unique factors that have negatively impacted the transportation sector of the economy that are not necessarily due to broader economic weakness, i.e., change in coal demand and one time rail track service issues. One will need to see confirmation of this point of view as additional data unfolds in the second quarter though.

No comments :

Post a Comment